Introduction

As a business owner, specifically in the retail sector, you probably have a well-established idea of how your business is perceived. However, the way that you see your brand and how consumers view your brand maybe two different stories. If this is the case, how can you first, figure out if there is a difference in perception, second, figure out what the difference actually is, and third, do something about it? Well, I have done my fair share of research, and I am here to tell you that there are 7 steps you can take to figure out all of this information.

This process is called figuring out your brand’s positioning. Figuring out how your brand is positioned in its overall sector is heavily based on consumers’ perceptions and behaviours. Now, these perceptions may not be the truth, it is important to note. But, these perceptions are the truth for the consumers and are directly related to how they will act in relation to your brand.

For example, if a shopper perceives Nike as being more sustainable than Adidas, and that is an important attribute when buying sneakers to them, they will choose to buy Nike brand shoes over Adidas, even if Adidas has more sustainable practices. Now, this situation is purely for example, but, if this were a factual scenario, Adidas might consider using this information to create a new branding strategy to highlight their sustainability efforts in order to reposition themselves, but we’ll get into the details later.

Why is determining your brand positioning beneficial? Knowing where your brand sits in the mind of your target consumers can help you find points of differentiation in your market and can help you understand how to adjust your company to fill the unsatisfied needs of your consumers. When your customers are accurately targeted, you can increase and boost profitability.

Let’s take a look at the 7 steps we’ll cover in this article, including two different models that will help us identify a brand’s positioning:

- Determine Your Competitors

- Create a List of Relevant Brand Attributes

- Draft a Multi-Attribute Model

- Analyse Data from Multi-Attribute Model

- Draft a Perceptual Map

- Analyse Data from Perceptual Map

- Draw Your Conclusions

- Conclusions

1. Determine Your Competitors

Determining your competition can be as simple as using your intuition to figure out which companies are most similar to yours. Or, it could be beneficial to go straight to the source and ask shoppers where else they consider buying similar products. The goal of this step is to identify not only which brands your consumers are comparing your company to, but also which brands are sharing the customers from your target market. It is important to consider any and all competitors, ranging from national brands to small businesses.

For an example, let’s look at a specialty store like Sephora. Sephora is a national brand that specializes in the sale of luxury beauty products, from makeup to haircare to skincare. When determining its competitors, Sephora will want to look at any brand that sells similar products via different business models, as well as companies with similar business models that might carry different products. Examples of Sephora’s competitors include, but are not limited to:

- Other beauty specialty stores (Ulta)

- Department stores (Nordstrom, Macy’s)

- Individual brand stores (MAC or Kiehl’s)

- Drug stores (Walgreens, CVS)

- Small boutique stores

This list provides a comprehensive look at the other brands that might be sharing customers with Sephora. Instead of focusing solely on stores that have the same marketing channel designs as Sephora, like Ulta, we are looking at all of the possible options that customers might buy beauty products from. This way, we will have a complete understanding of how consumers perceive the brand in comparison to all kinds of other stores when we move onto our next steps.

2. Create a List of Relevant Brand Attributes

The next step in the positioning process is to generate a list of brand attributes that are relevant to your business. Similarly to step one, this step can be done from your own intuition, although it is helpful to enlist the guidance of active consumers to gain a clear understanding of what is important and actually considered during shopping. With multiple opinions, you should be able to construct a comprehensive list of important aspects of the purchasing experience.

In our Sephora example, attributes that might be considered could be:

- Range of products carried

- Affordability

- In-Store Experience

- Customer service

This list can be applied to any of the retailers that we have discussed above, as all of them can be related to these attributes. In the following steps, we’ll use these attribute examples to begin formulating an idea of how the brand is positioned in customers’ minds.

3. Draft A Multi-Attribute Model

In this step, we will look at how to begin drafting a model using the information from the first two steps. Here, it is crucial to enlist the help of consumers who have all levels of involvement in your given sector.

A multi-attribute model will compare the attributes you have identified as important and how they rank with your business along with your various competitors. Data can be recorded in any spreadsheet software, and for those of you that aren’t as technology savvy, excel templates are available with a quick browser search.

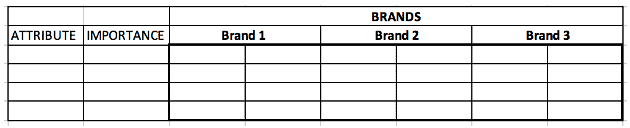

A basic example of a multi-attribute chart will look as follows:

To fill out this chart, the consumers will pick rank the attributes given on a scale of 1-10, 1 being not important to their shopping experience, and 10 being very important to their shopping experience. Ideally, no two attributes will have the same value of importance assigned to another. Then, the consumer will continue to fill out how they feel each brand ranks in each of the attributes and record their data in the left column for each brand. In the right column next to each brands’ rankings, we will multiply the rank by the value of importance for each attribute. With these numbers, we can begin to compare each company to each other.

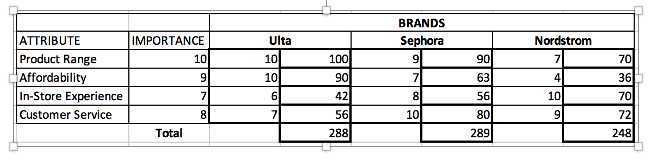

Here’s an example of how Sephora’s completed multi-attribute model may look:

4. Analyse Data from a Multi-Attribute Model

Now that we have a completed data table for the Multi-Attribute model, let’s take a look at how to assign meaning to the numbers. In our Sephora example, we can see that although it was very close, Sephora was the preferred beauty retailer in this case according to the total numbers. This model is very beneficial when determining consumers’ preferred brands in relation to certain attributes.

However, if Sephora saw this model, they might realize how important affordability is to shoppers for example, and the brand could see this as an opportunity to improve on this attribute, considering it does not have a very high score when compared to its competitor, Ulta. Customers may be deterred from buying everyday products from Sephora due to its average product price, and they may look to reform this positioning as an expensive brand. Ways to achieve this change in perception will often times generate in the marketing or advertising department.

5. Draft a Perceptual Map

Creating a perceptual map serves a different purpose than a multi-attribute model – instead of describing preferred retailers, perceptual maps give a closer look at overall market perceptions. To create a perceptual map, you need to start with just two attributes, one to put on each of two axes. Traditionally, it is best to steer clear of using “price” vs “quality” and instead use two attributes that are more descriptive but can still be related.

In our Sephora example, we might use “product range” vs “customer service”. The next step in drafting a perceptual map is to create a survey for consumers to fill out regarding their perception of Sephora and its competitors in these two attributes. This might look something like:

- On a scale of 1-10, how varied would you consider Sephora’s product range to be? (1 = not varied, 10 = very varied)

- On a scale of 1-10 how helpful would you consider Sephora’s customer service to be? (1 = not helpful, 10 = very helpful)

These exact questions would be repeated for each of the competitors that are being compared. The average of each consumers’ answers would be recorded and then plotted on the actual perceptual map. As with the multi-attribute models, perceptual map templates can be provided online.

What will result is a plotted map of circles that will create a visual representation of the competitors to each other. The following is a very simplified example of what a perceptual map may look like. Most likely, a fully executed perceptual map will have four quadrants to compare the brands.

6. Analyse Data from Percepetual Map

The goal of creating a perceptual map is to identify the “white space” in the grid. This white space can mean there’s an opportunity to expand into the marketspace that your competitors currently are not occupying. Doing so will help you differentiate yourself from your competitors and help your brand stand out in your customers’ minds. By understanding the perceptual map, you can potentially fill needs in your customers’ lives that you previously, and they previously might not have known. In some cases, the white spaces exist for a reason, due to the fact that they may not present a profitable opportunity for the business.

7. Draw Your Conclusions

Based on these steps, you can have a clear picture of how consumers perceive your brand as a whole when compared to other market competitors. The same processes can be used to draw comparisons of the perceptions of single products within a market as well.

Based on the data you find in these models, you can begin to consider how to move forward with your brand positioning. If you are unhappy with your brand positioning, you can attempt to shift perceptions in a few ways. One way would be to try to change beliefs. In our example, Sephora might try to advertise that they are an affordable brand instead of a luxury brand. Or, the band can attempt to change the weight of importance values by trying to advertise an already existing attribute. Another option to move forward might be the addition of a new belief to attribute to the brand.

8. Conclusions

While we’ve placed a strong emphasis on the fashion and beauty industries, brand positioning is relevant for any industry or sector. Any company can benefit from understanding how its consumers perceive it in comparison to its competitors, and anyone can analyze their brand positioning with these 7 steps. First, you have to identify your market and the competitors that may be sharing your customers. Second, create a list of attributes that are relevant to your brand. Third, use these attributes to create a multi-attribute model. Fourth, analyze the data collected in the model to understand where your brand ranks on different values. Fifth, create a perceptual map to get an overall idea of the perceptions of the market. The sixth step is to analyze the perceptual map data and find potential opportunities within the market. Finally, the seventh step is to use the models that you have created to form a well-rounded idea of the perceptions of your company and how to position your company in the future.