Introduction

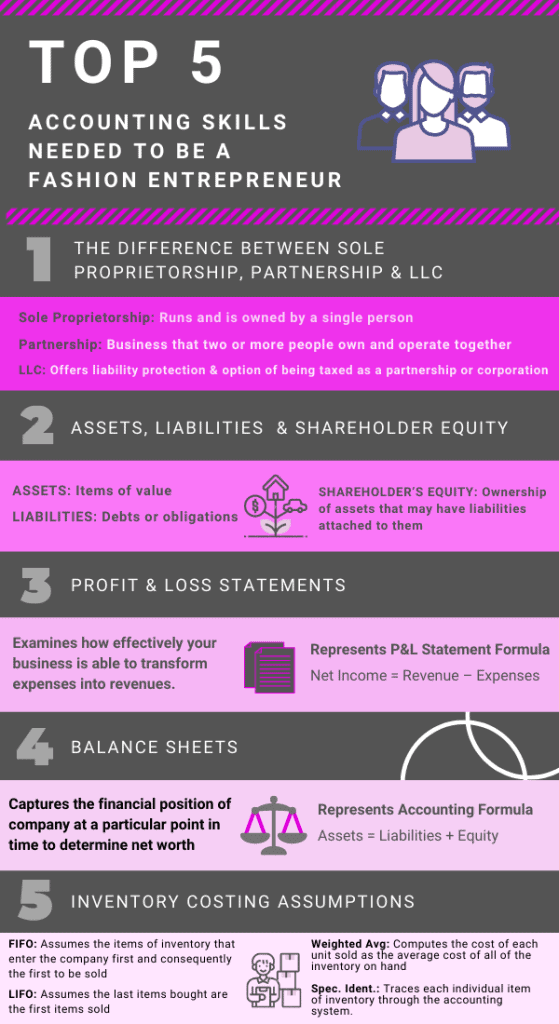

As an aspiring fashion entrepreneur, it is easy to be caught up in the creative aspects of launching a startup: deciding on a name, developing the brand, and designing your product or service. While accounting may not be a point of attraction for many creative individuals, it is an essential practice that all entrepreneurs should have a basic understanding of.

As a fellow creative, I recognize how daunting it can be to address the analytical side of a business. I often reflect on my first week of business school and how nervous I was when introduced to the topics we’re covering today. Although these subjects may seem unfamiliar at the moment, we encourage you to keep an open mind as we break them down step by step to ensure you leave with a solid understanding of not only why these skills are important to acquire, but also how you can apply them to your own ventures. Let’s get started with the Top 5 Accounting Skills Needed to be a Fashion Entrepreneur:

Understanding…

- The Difference Between a Sole Proprietorship, Partnership, and LLC

- Assets, Liabilities, and Shareholder Equity

- How to Read a Profit and Loss Statement

- How to Read a Balance Sheet

- Inventory Costing Assumptions

- Conclusions

1. The Difference Between a Sole Proprietorship, Partnership, and LLC

Before you consider any of the following business structures, you should first identify existing fashion business models to follow or take inspiration from and begin mapping out your own model. Remember, it should be realistic and complimentary to your customer value proposition. If you ever feel stuck at this stage, refer to the Business Model Canvas, which is a helpful guide for establishing your company vision and plan. The BMC prompts you to address questions and gain insight as to which of the following structures fits best with your model.

In an ever-changing industry like fashion, it’s critical to understand how your future business decisions will impact the success of the company.

Our first accounting skill, understanding the various types of taxation and legal structures that exist, will assist you in crafting the final business plan you’ll present to investors. To learn more about specific parts of a business plan, check out our How to Write a Business Plan for Your Fashion Brand blog. Now, let’s begin by analysing the 3 most common types of business structures:

Sole Proprietorship. A Sole Proprietorship is a business that runs and is owned by a single person. This is a good option if you’re someone who prefers to have complete control over your business operations. Like any structure, there are advantages and disadvantages you’ll need to consider.

- Advantages: Given that sole proprietorships do not produce a separate business entity, the owner’s business assets and liabilities are not separate from personal assets and liabilities. Sole proprietors are required to include both their business expenses and personal income on their tax return, which offers a significant amount of tax savings in the future. This structure is typically easier and more affordable for individuals.

- Disadvantages: Sole proprietors are “solely” responsible for the business’s liabilities, debt, and losses. If a business goes into debt, the owner’s personal assets may be at risk. There is no legal division between the entity and the owner, which leaves entrepreneurs with less legal and tax protection.

Partnership. A Partnership is a business that two or more people own and operate together. The partners have a financial investment in the firm and coordinate with each other during decision-making processes.

- Advantages: General partnerships are typically less costly to set up. A primary advantage is that one partner shares the responsibilities, resources, and losses with another, lessening liability.

- Disadvantages: Partnerships offer little asset protection, which presents a costly risk if the business were to be sued. It’s common for one partner to be co-responsible for the business actions and decisions of the other partner, even if they did not participate.

LLC. A Limited Liability Company is a business structure that offers personal liability protection and the option of being taxed as a partnership or corporation.

- Advantages: Owners of an LLC are protected from debts and legal judgements. LLCs are commonly established for the purpose of preserving assets such as real estate, vehicles, and income earning potential. Owners can also opt to be taxed as either a corporation or partnership, meaning that the company can avoid paying tax on corporate profits as well as their own personal income.

- Disadvantages. Owners have an obligation to pay their own unemployment compensation. These individuals are considered self-employed, which means they pay into their own social security and Medicare accounts as well. This is not the case in a sole proprietorship. This structure is also more expensive to implement

Not too bad, was it? That’s the beauty of accounting, it’s not just a mindset, but it’s also a language. Learning how to use the correct terminology will help you better convey your ideas to investors and customers. This is the reason why accounting is also called the language of business. Talking about using the right terminology, in the next section of the post we’re going to explain what we mean with assets, liabilities and shareholder’s equity.

2. Assets, Liabilities, and Shareholder Equity

Assets, liabilities, and equity are the three components of a balance sheet. The Accounting Formula (Assets = Liabilities + Equity) uses these metrics to test if a balance sheet is “balanced”. Why do fashion entrepreneurs need to know about these? These three categories allow entrepreneurs and their investors to evaluate the overall health of the company.

Assets. Assets consist of any resource, material, or object of value a company possesses. For example, if you plan to open a retail business with staff, you’ll need to lease a suite and purchase fixtures, technology, and supplies to run operations. You’ll also need mannequins, store materials, and of course—inventory! We can segment these assets into a few categories, but here are the main two:

- Current Assets: Short term assets that are expendable within one year.

- Fixed Assets: Long-term assets. These assets have low liquidity due to their relative permanence. An example would be the building or vehicles a company uses for operations.

Together, both types of assets bring value to your company and allow you to generate cash flow.

Liabilities. Liabilities fall under the umbrella of everything the company owes to other entities. Suppliers, customers, distributors, government tax agencies, and banks are examples of common collectors that owners are liable to. Just like assets, any liabilities that a business owner will need to pay off within a year are called current liabilities. Separating current liabilities from long-term liabilities, like loans, allows business owners to plan accordingly for short-term commitments.

Shareholder Equity. Shareholder Equity represents the current net worth of the company. It shows the assets that the company owns after recognizing its expenses and liabilities. Here are some categories of equity and how they are presented on the balance sheet

- Owner, Shareholder, or Stockholder Equity: Terms used to describe equities based on the business structure. Equity lines in these statements may be labelled as Capital, Net Income, Paid-in Capital, Retained Earnings Accumulated, Other Comprehensive Income, or Treasury Stock.

Interesting in learning more about financing your fashion start-up with private equity investments? Visit our blog here.

3. How to Read a Profit and Loss Statement

The Profit and Loss Statement summarizes financial transactions in order to report revenues and expenses for the purpose assessing the operating performance of a business. This is a useful tool for small-business owners to pinpoint which areas of their business are performing under or over budget.

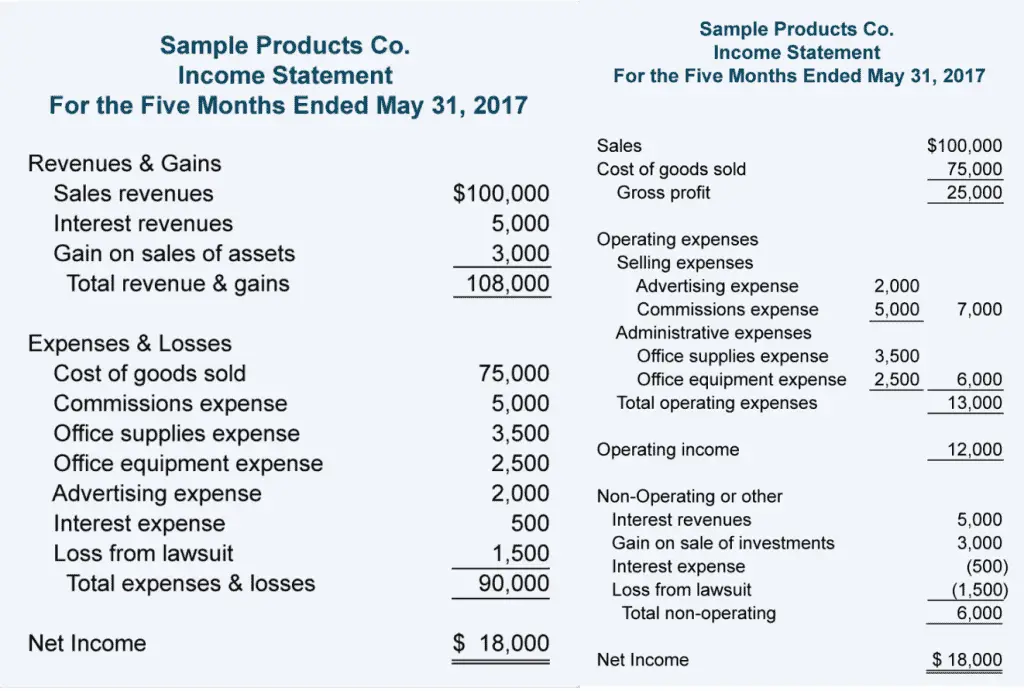

The income statement is broken into sections of lines grouped together by categories. The category formatting guidelines depend on if the company is taking a single step or multi-step approach when creating their statement, take a look at the picture below for an example.

- Single-step income statement: Simplified report of a company’s profit, using one equation to calculate the net income.

- Multi-step income statement: Separates operational revenues and expenses from non-operational ones through a series of multiple equations.

- Gross Profit = Net Sales – Cost of Goods Sold

- Operating Income = Gross Profit – Operating Expenses

- Net Income = Operating Income + Non-Operating Items

At the top of the statement are the Revenues, next are Expenses, and finally, we calculate our Net Income by subtracting Total Expenses from Total Revenue. Refer to the pictures below to see the difference in statements:

Simple VS. Multi Step

Great. Now let’s move ahead to the balance sheet, and how it provides a picture of our organisation, in terms of what it owns and owes. Intrigued? Read further!

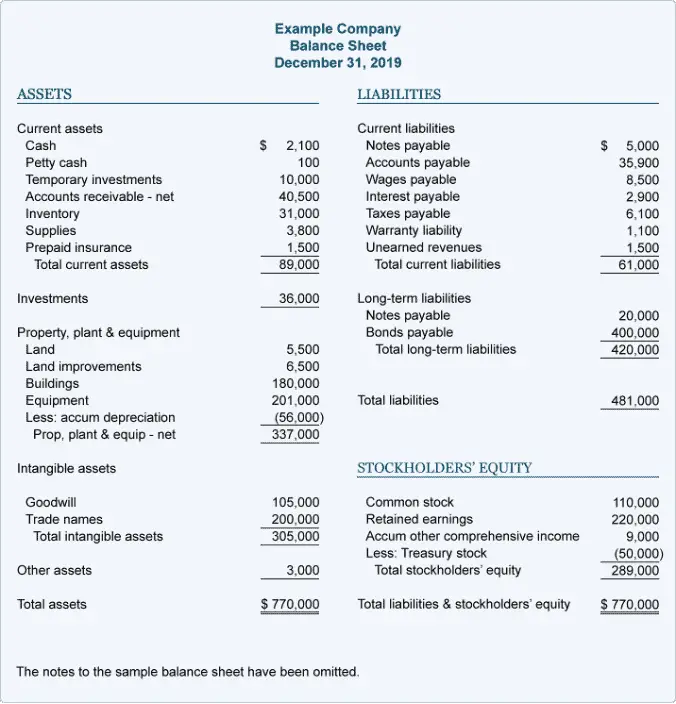

4. How to Read a Balance Sheet

The balance sheet, unlike the income statement or other financial reports, is a “snapshot” of a company in a specific moment in time. Balance Sheets provide knowledge of the businesses’ financial position, as well as what they own and owe.

All balance sheets tend to follow the same formatting guidelines:

- Divided into three components: Assets, Liabilities, and Shareholder Equity.

- Assets are on the left, liabilities are on the right, and Shareholder Equity right below.

Every company hopes to report a positive equity amount on its balance sheet. If a company’s debts exceed its profits for that period, we consider this a deficit. Shareholders have no responsibility to cover the business’s debts, but they may lose up to their initial investment amount.

Now that we’ve dominated financial statements, we can move onto something very dear to fashion merchandisers and producers, inventory costing assumptions. The name may be intimidating, but it’s actually a very intuitive approach to keeping your costs in check.

5. Inventory Costing Assumptions

Keeping an accurate record of profit and revenue stream from fluctuations in inventory is very important. Let’s consider this example. A fashion entrepreneur is looking to account for merchandise inventory must first choose an inventory cost flow assumption. This assumption is a rule for how the accounting system assumes that inventory costs move through the organization.

- FIFO (First in, first out) Method: This method assumes the items of inventory that enter the company first and consequently the first to be sold. The calculated inventory flow does not need to match the physical flow. Companies that sell products with shorter demand cycles, such as designer fashion, often choose FIFO so they can have a quick turnover of items expected to become outdated. FIFO companies will often pay higher taxes than LIFO companies.

- LIFO (Last in, first out) Method: This method assumes the last items bought are the first items sold. Although this isn’t the primary option of many small businesses, it does offer one key advantage. In industries with rapidly rising costs of merchandise inventory, the LIFO method can offer significant tax savings. When the Cost of Goods Sold is comprised of mainly newer and more expensive items, the overall net income is kept low. As time goes on and inventory levels increase, price discrepancies between the expensed products and the ones kept in the inventory increases

- Weighted Average: This method falls right in the middle between the LIFO and FIFO methods. Instead of assuming that either the oldest or newest inventory is sold through first, the company computes the cost of each unit sold as the average cost of all of the inventory on hand. While this eases tax and income considerations, the calculation for this method requires a recalculation of the cost of inventory at the time of each sale transaction and purchase. For many small business owners who may be short on time and resources, these additional requirements outweigh the advantages.

- Specific Identification: Specific Identification is perfect for merchandiser entrepreneurs who sell smaller quantities of custom merchandise. This method requires companies to track each individual product in inventory through the accounting system. As an example, a merchandiser selling one type of purse under the FIFO method would assume that the cost of each purse sold is the cost of the oldest purse left in inventory. Using the specific identification method, the business would use the actual cost of the purse selected by the consumer, regardless of its age. When analysing this method on a smaller scale, it can provide very accurate costs. Conversely, on a larger scale, this method can go off the rails very quickly.

And that’s it! Well done, now that accounting does not scare you anymore, you can go into as much depth as you like in these topics, and build on new management skills. Need a refresher? Just take a look at our conclusions below.

6. Conclusions

As fashion entrepreneurs, the accounting skills covered in this blog will play a vital role in running a business. We identified 5 top skills:

- Understanding the legal and tax differences among a Sole Proprietorship, Partnership, and LLC

- Using the Profit and Loss Statement to examine how effectively your company is able to transform expenses into revenues.

- Using the Balance Sheet to capture the financial position of a company at a particular point in time and determine net worth

- Understanding the categories used to produce these documents:

- Assets: The resources of business such as cash, securities, technology, accounts receivable, inventories, fixtures, machinery, buildings, and supplies.

- Liabilities: Debts or obligations owed to another entity.

- Shareholders’ Equity:

- Understanding Inventory Cost Assumptions

Using these accounting tools will provide investors, management, and yourself with meaningful financial information to assist in making quality decisions.